Introduction

Navigating the complexities of international trade presents significant challenges for businesses, particularly in adhering to constantly changing regulations. Importer of record services are essential in facilitating the smooth and efficient movement of goods across borders, protecting companies from potential delays and penalties. As organizations seek to improve their logistics operations, a critical question emerges: how can they effectively utilize these vital services to enhance their supply chains and reduce risks? This article explores the key importer of record services that can streamline logistics and enable businesses to succeed in a competitive global marketplace.

Crossfire Logistics: Comprehensive Importer of Record Services for Streamlined Customs Compliance

Crossfire Logistics offers a comprehensive suite of importer of record services designed to simplify regulatory compliance for businesses in Hampton Roads. These services encompass meticulous management of all necessary documentation, accurate product categorization, and the administration of duties and taxes.

Accurate product categorization is crucial; misclassification can lead to significant delays and additional costs. For instance, Canadian companies alone incurred millions in losses in 2022 due to such errors. By capitalizing on their extensive experience and strategic location near the Ports of Norfolk, Crossfire Logistics enables clients to navigate the complexities of international trade with both confidence and efficiency.

This proactive approach not only mitigates risks associated with regulatory compliance but also enhances operational efficiency through importer of record services, allowing organizations to focus on growth. Successful case studies, such as those demonstrating a 30% increase in export revenue through effective regulatory management, underscore the vital role of Crossfire's services in achieving seamless logistics operations.

Drip Capital: Expert Importer of Record Services for Efficient Customs Management

Drip Capital specializes in offering importer of record services that significantly enhance border management for businesses. Their expertise lies in navigating complex regulatory environments and ensuring compliance with U.S. Customs and Border Protection (CBP) requirements.

By offering tailored solutions, Drip Capital helps enterprises mitigate risks associated with customs delays and penalties. This approach not only safeguards compliance but also improves overall operational efficiency.

AIGCC: Climate Risk Insights for Importer of Record Services

The Asia Investor Group on Climate Change (AIGCC) highlights the critical need to integrate climate risk insights into importer of record services. As companies face increasing scrutiny regarding their environmental impacts, importer of record services that incorporate climate risks can enhance compliance and sustainability.

By implementing strategies that address climate-related risks, companies not only meet regulatory requirements but also bolster their overall supply chain resilience.

Understanding the Role of Importer of Record in Global Trade Compliance

The role of importer of record services is vital in global trade regulation. This entity is responsible for providing importer of record services to ensure that imported goods comply with all legal and regulatory requirements. Key responsibilities include:

- Handling import documentation

- Paying relevant duties and taxes

- Ensuring adherence to local regulations

During the clearance process, the IOR acts as the legal proprietor of the goods. This function is essential for facilitating seamless international transactions by utilizing importer of record services.

Key Responsibilities of an Importer of Record for Successful Logistics Operations

An Importer of Record (IOR) is crucial for ensuring smooth logistics operations through several key responsibilities:

-

Ensuring Accurate Product Classification: Proper classification of goods is essential to avoid penalties and ensure compliance with customs regulations. Precise categorization aids in prompt border clearance and helps identify relevant duties and taxes, significantly influencing total expenses.

-

Managing Compliance Documentation: The IOR handles all necessary paperwork for customs clearance, including compliance documents, transport and logistics documents, and financial records. Businesses often spend considerable time-sometimes several hours-preparing these documents, making efficiency in this area vital for minimizing delays.

-

Paying Duties and Taxes: Timely payment of all relevant fees is essential to avoid delays at the border. The IOR must ensure that all duties and taxes are calculated accurately and paid promptly to facilitate the smooth movement of goods across borders.

-

Maintaining Records: Keeping accurate records is essential for compliance audits and can help mitigate risks associated with international trade. Regular assessments and systematically organized records can prevent costly fines and ensure compliance with trade regulations.

These responsibilities, particularly importer of record services, extend beyond mere administrative tasks; they are critical for successful logistics operations. For example, a home and living manufacturer centralized its product information, resulting in a 55% faster time-to-market, showcasing the benefits of effective IOR practices. Companies that prioritize accurate product classification and diligent record-keeping often experience smoother customs processes and a reduced risk of penalties. By effectively managing these aspects, importers can enhance their operational efficiency and ensure adherence to U.S. regulations with the help of importer of record services.

Benefits of Engaging an Importer of Record for Cost-Effective Supply Chain Solutions

Engaging importer of record services provides numerous benefits that significantly enhance supply chain efficiency and cost-effectiveness.

-

Cost Savings: Ensuring compliance with import regulations helps businesses avoid penalties, leading to substantial savings on unexpected costs. Firms that utilize importer of record services have reported an average reduction in clearance duration by up to 30%, which translates into lower operational expenses.

-

Streamlined Processes: Importer of record services simplify customs clearance, effectively minimizing delays and enhancing overall efficiency. This is especially vital in today’s fast-paced logistics environment, where timely delivery is essential for maintaining a competitive edge.

-

Expert Guidance: Access to professionals who specialize in navigating complex regulations ensures organizations remain compliant while optimizing their logistics strategies. This expertise can yield significant cost savings through adherence, as improper documentation may result in fines or shipment delays. Crossfire Logistics prides itself on its commitment to integrity and proficiency in supply chain management, making it an ideal partner for enterprises seeking importer of record services.

-

Risk Mitigation: Utilizing an IOR decreases the likelihood of customs-related issues that can disrupt operations. By actively managing regulations and documentation, organizations can avert costly disruptions in their supply chain. Crossfire's strategic facilities near Norfolk International Airport and VIT terminals further enhance its ability to mitigate risks associated with importation.

These benefits underscore the importance of importer of record services as a crucial component of a cost-effective supply chain strategy, enabling companies to focus on their core operations while ensuring seamless importation processes.

Types of Importer of Record Services: Choosing the Right Fit for Your Business

Various Importer of Record (IOR) services cater to distinct business needs:

-

Direct Importer Services: These are ideal for businesses that prefer to manage their own imports. This approach allows for greater control over the import process and compliance management. Importers must have a financial interest in the imported merchandise to fulfill their responsibilities effectively.

-

Third-Party IOR Services: This option is increasingly popular among companies looking to outsource their IOR responsibilities. It minimizes compliance risks and streamlines operations. Many businesses report enhanced efficiency and reduced costs with this choice. Selecting the right importer of record services can have a significant impact on the success of your imports into Mexico.

-

Broker IOR Services: These are suitable for organizations that require specialized knowledge in brokerage. While customs brokers typically assist with documentation, some may also act as the IOR. However, this is less common due to potential conflicts of interest arising from assuming financial liabilities.

Selecting the right importer of record services is contingent upon the specific needs and capabilities of the organization. Companies must consider factors such as import volume, compliance capabilities, and the strategic objectives of their supply chain. Engaging with a knowledgeable IOR can significantly impact the success of imports, ensuring timely deliveries and adherence to regulations. As Patricia Carrillo advises, researching the IOR’s reputation and track record is essential for making an informed choice.

How to Obtain Your Importer of Record Number for Smooth Customs Clearance

To successfully obtain an Importer of Record (IOR) number, businesses must follow these essential steps:

- Fill out CBP Form 5106: This document is crucial for establishing or modifying the importer identity within the border control system.

- Provide Required Documentation: Include proof of identity and business registration, which are critical for verification.

- Submit the Application: Deliver the completed form along with the necessary documentation to the specified clearance office.

- Await Approval: After submission, monitor the application status. Upon approval, the IOR number will be issued, which will enhance efficient customs clearance through importer of record services.

It's noteworthy that approximately 70% of companies successfully obtain their IOR numbers on their first application. This statistic highlights the importance of thorough preparation and adherence to the requirements. Additionally, companies should stay informed about any updates or changes to the CBP Form 5106 requirements, as these can impact the application process. Common challenges include incomplete documentation and misunderstandings regarding the form's requirements, which can lead to delays. By following these steps and being aware of potential challenges, businesses can manage the process efficiently with the help of importer of record services, ensuring compliance and minimizing delays in their logistics operations.

Importer of Record vs. Exporter of Record: Key Differences Explained

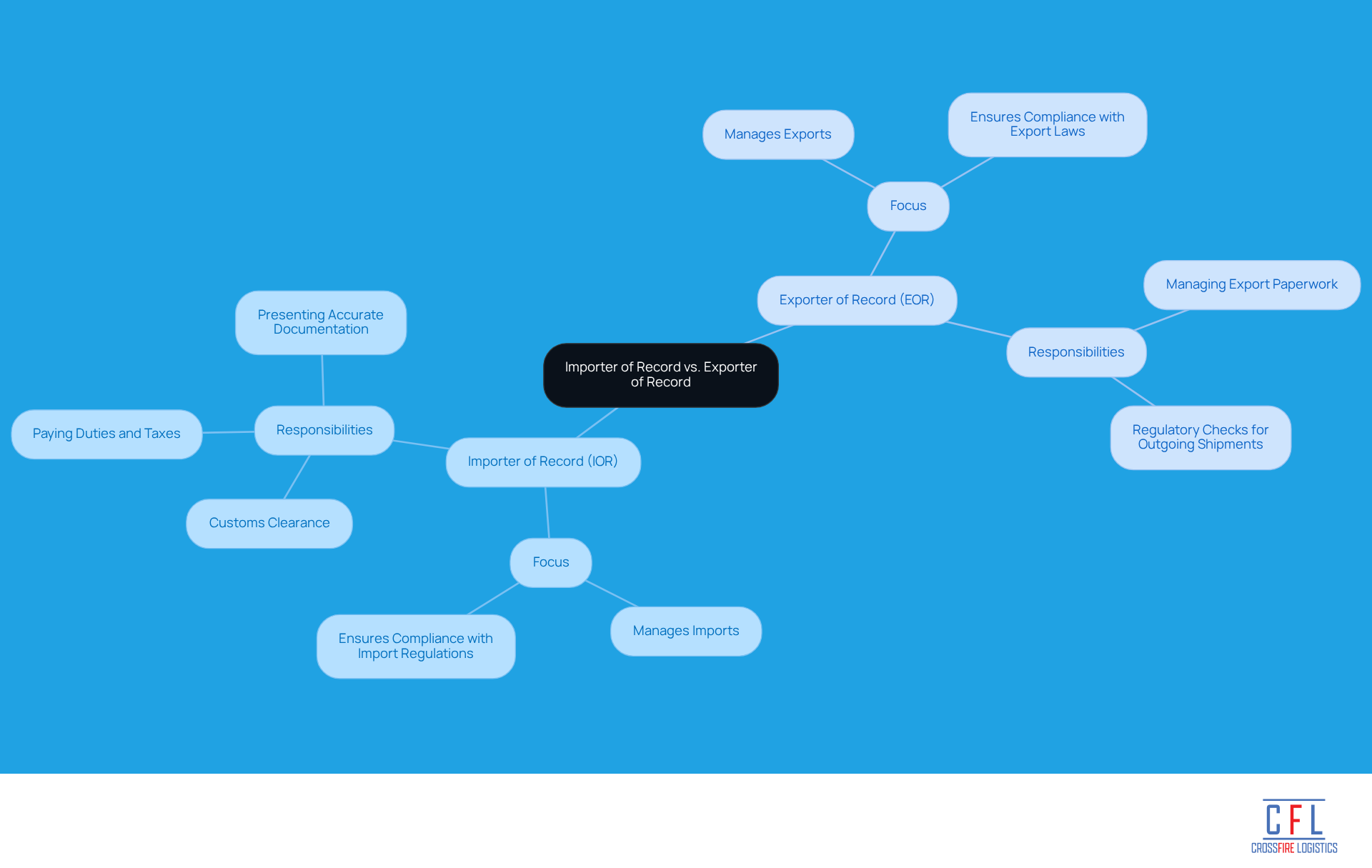

The distinctions between Importer of Record (IOR) and Exporter of Record (EOR) are critical for effective logistics management:

- Focus: The IOR manages imports, ensuring compliance with all import regulations. In contrast, the EOR oversees exports, ensuring adherence to export laws. The importer of record services operate within the importing country, facilitating the entry of goods. Meanwhile, the EOR functions in the exporting country, managing the exit of goods.

- Responsibilities: The importer of record services include customs clearance and ensuring that all incoming goods meet regulatory requirements. Conversely, the EOR manages the necessary paperwork and regulatory checks for outgoing shipments.

Understanding these distinctions is crucial. Many companies may not fully grasp the implications of these roles, which can lead to regulatory issues and operational inefficiencies in the supply chain. Worldwide trade delays cost the economy over $1 trillion each year, underscoring the importance of efficient importer of record services and EOR strategies. As One Union Solutions states, 'We simplify the complexities of global trade with end-to-end importer of record services and Exporter of Record support.

Who Can Be an Importer of Record? Key Qualifications and Considerations

To qualify as an Importer of Record (IOR), an entity must meet several key criteria:

-

Have a Legal Presence: The entity must be established in the country of import, ensuring compliance with local laws and regulations. This legal presence is crucial for managing the responsibilities associated with importing goods.

-

Obtain an Importer Number: Registration with regulatory authorities is essential to secure an IOR number, which uniquely identifies the importer to U.S. Customs. U.S. companies typically use their IRS Employer Identification Number (EIN) for this purpose. Foreign entities must complete Form 5106 to apply for a CBP-assigned importer number, which adds complexity to their process.

-

Meet Financial Requirements: The IOR must demonstrate financial stability, possessing the capacity to pay all duties and taxes related to imports. Statistics indicate that a substantial percentage of enterprises successfully meet these financial requirements, underscoring the importance of fiscal responsibility in this role. Many companies discover that upholding a bond is crucial for assuring adherence and financial responsibility.

-

Understand Compliance Regulations: A thorough understanding of local import laws and regulations is vital. This knowledge allows the IOR to manage the intricacies of compliance with regulations effectively. As Joe DeSilvestri notes, "The role of the Importer of Record sounds simple enough, but it carries significant legal responsibilities for valuing, classifying, and assessing duties on U.S. imports."

These qualifications ensure that the importer of record services can effectively manage the legal and financial responsibilities associated with importing goods, thereby facilitating a smoother logistics process. Additionally, logistics coordinators should consider consulting with licensed customs brokers to navigate the complexities of becoming an IOR and to understand the implications of hiring freight forwarders, which can vary based on the services they offer.

Conclusion

Engaging with importer of record services is essential for businesses looking to navigate the complexities of international logistics and customs compliance effectively. These services simplify the regulatory landscape and enhance operational efficiency, enabling companies to concentrate on their core missions while ensuring smooth importation processes.

This exploration of essential importer of record services has presented key arguments that highlight the importance of:

- Accurate product classification

- Meticulous documentation management

- Timely payment of duties and taxes

Partnering with expert providers like Crossfire Logistics and Drip Capital can mitigate risks, streamline operations, and ultimately lead to cost savings and improved supply chain resilience.

As global trade continues to evolve, businesses must prioritize their engagement with importer of record services to remain competitive and compliant. By understanding the critical role these services play, organizations can better position themselves for success in an increasingly complex marketplace. Embracing these strategies safeguards against potential pitfalls and paves the way for sustainable growth and operational excellence in logistics.

Frequently Asked Questions

What services do Crossfire Logistics offer as an importer of record?

Crossfire Logistics provides a comprehensive suite of importer of record services that includes meticulous management of necessary documentation, accurate product categorization, and administration of duties and taxes.

Why is accurate product categorization important in customs compliance?

Accurate product categorization is crucial because misclassification can lead to significant delays and additional costs. For example, Canadian companies faced millions in losses in 2022 due to such errors.

How does Crossfire Logistics enhance operational efficiency for businesses?

Crossfire Logistics enhances operational efficiency by providing importer of record services that help organizations focus on growth while navigating the complexities of international trade confidently.

What are some outcomes of using Crossfire Logistics' services?

Successful case studies indicate that effective regulatory management through Crossfire's services can lead to a 30% increase in export revenue, demonstrating their vital role in seamless logistics operations.

What is Drip Capital's specialization in importer of record services?

Drip Capital specializes in offering importer of record services that enhance border management and ensure compliance with U.S. Customs and Border Protection (CBP) requirements.

How does Drip Capital help businesses with customs management?

Drip Capital helps businesses mitigate risks associated with customs delays and penalties by offering tailored solutions that safeguard compliance and improve overall operational efficiency.

What role does AIGCC play in importer of record services?

The Asia Investor Group on Climate Change (AIGCC) emphasizes the importance of integrating climate risk insights into importer of record services to enhance compliance and sustainability.

How can companies benefit from addressing climate-related risks in their importer of record services?

By implementing strategies that address climate-related risks, companies can meet regulatory requirements and bolster their overall supply chain resilience.