Introduction

Understanding the complexities of freight insurance is crucial for businesses navigating logistics. Numerous factors influence insurance rates, including cargo value and shipping methods. By grasping these intricacies, companies can uncover significant savings and optimize their coverage.

As the logistics landscape evolves, businesses face the challenge of managing these variables effectively. The key question is: how can they secure lower rates while ensuring comprehensive protection against potential losses? This article will explore strategies to address these challenges, providing insights into effective freight insurance management.

Crossfire Logistics: Impact of Comprehensive Logistics Solutions on Freight Insurance Rates

Crossfire Logistics provides a comprehensive suite of logistics solutions, including tailored warehousing and drayage services, which significantly influence freight insurance rates. By optimizing operations and ensuring timely deliveries, the company effectively reduces the likelihood of claims - an essential factor in determining coverage costs.

Efficient cargo handling mitigates risks, thereby enhancing the overall safety of shipments. This proactive strategy not only boosts customer satisfaction but also positions clients favorably with providers, potentially leading to lower expenses.

Statistics indicate that domestic shipping routes typically feature freight insurance rates that range from 0.1% to 0.4% of the cargo's value. Companies that demonstrate strong operational efficiency often benefit from reduced costs. Real-world examples reveal that logistics firms implementing streamlined processes have successfully decreased premiums by 10-20%, underscoring the tangible benefits of effective logistics management on freight expenses.

To enhance your freight coverage management further, ensure that your documentation accuracy exceeds 95%. This is crucial for minimizing claims and further reducing costs.

Cargo Value: How the Worth of Goods Affects Freight Insurance Costs

The value of the cargo being transported is crucial in determining the freight insurance rates. Generally, the higher the value of the items, the greater the cost for coverage. High-value items, such as electronics or luxury products, require more extensive coverage, which can significantly increase expenses.

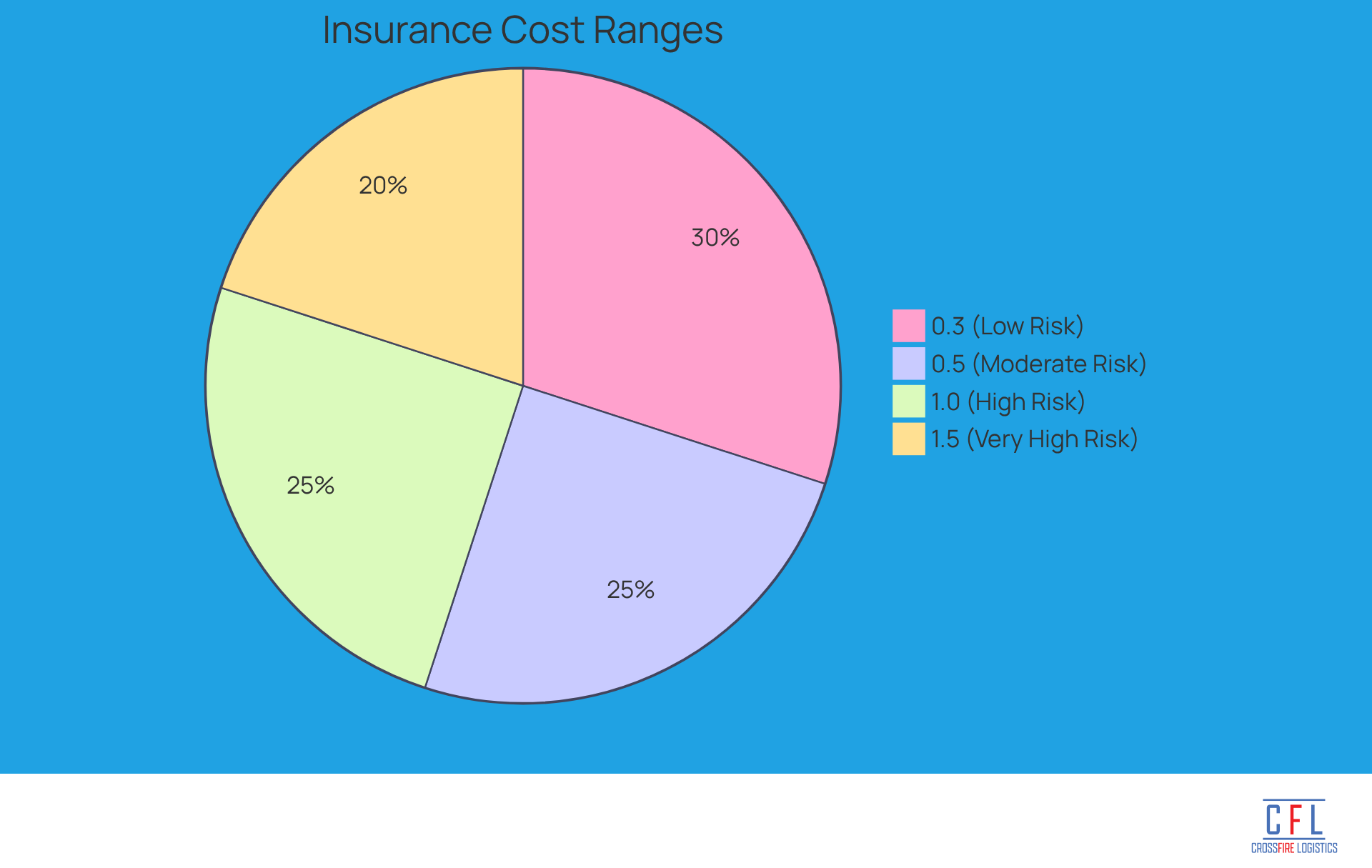

In 2025, typical costs for insuring high-value items range from 0.3% to 1.5% of the Total Insured Value (TIV). This variation reflects the increased risk associated with these products. Businesses must accurately assess the value of their cargo to avoid underinsurance, which could result in substantial financial losses in the event of damage or theft.

Additionally, factors such as route hazards and maintaining a strong claims history can greatly influence coverage expenses. Implementing effective risk management strategies, along with investing in quality packaging and secure handling, can further reduce costs. Therefore, it is essential for logistics coordinators to consider these factors when insuring high-value goods.

Shipping Routes: The Role of Risk Assessment in Freight Insurance Pricing

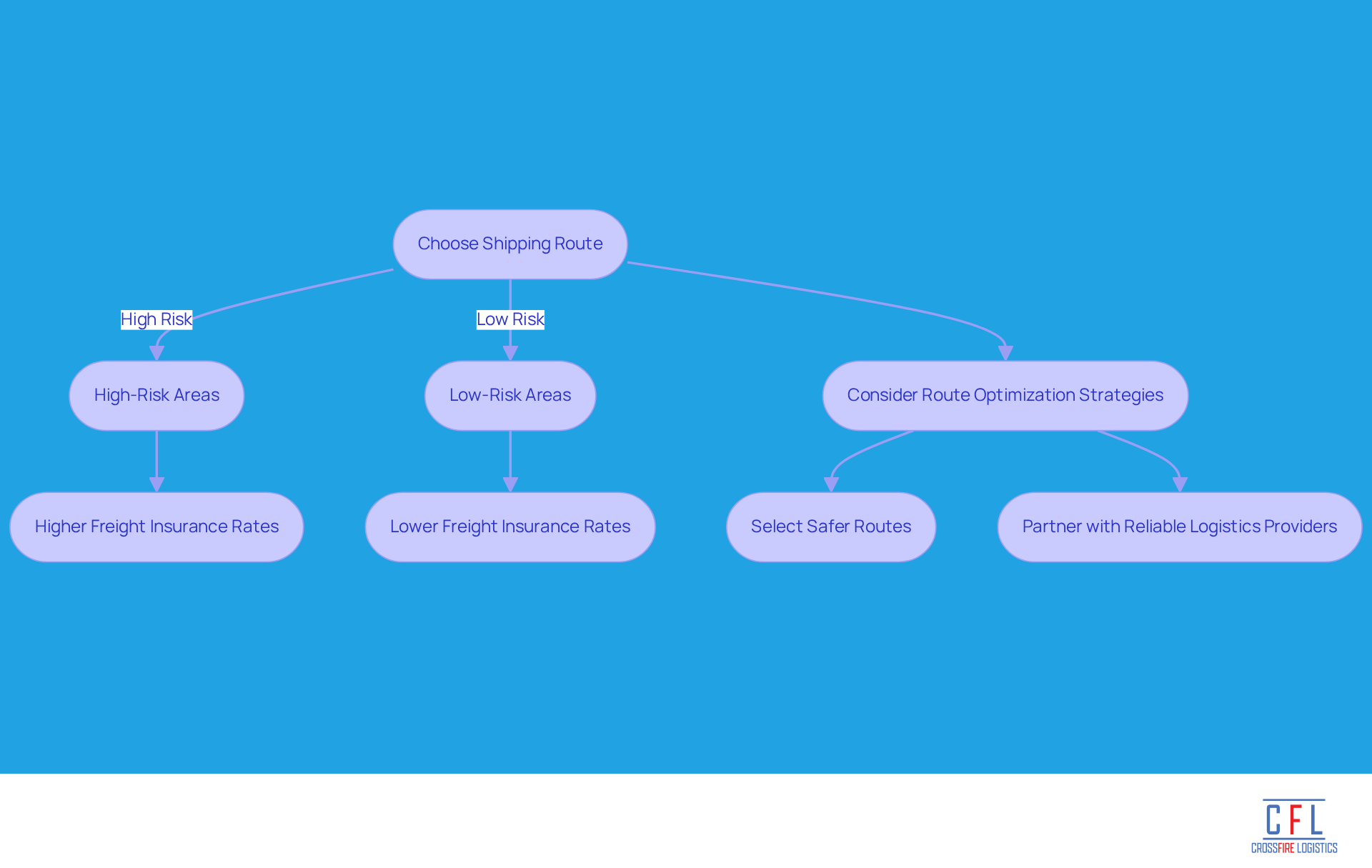

The choice of shipping route can significantly influence the pricing of freight insurance rates. Routes that traverse high-risk areas, such as regions with elevated theft rates or adverse weather conditions, often result in higher freight insurance rates. Providers assess these uncertainties when determining coverage costs. Therefore, companies should consider route optimization strategies to mitigate costs associated with freight insurance rates.

By selecting safer routes or partnering with logistics providers known for robust management practices, companies can potentially lower their coverage costs.

Type of Cargo: Understanding How Different Goods Impact Insurance Rates

The type of cargo being transported significantly influences freight insurance rates. Fragile items, hazardous materials, and perishable goods typically incur higher costs due to their increased risk of damage or loss during transit. For instance, transporting food items often requires additional protection against spoilage, which can substantially impact coverage expenses. Similarly, moving hazardous substances necessitates specific insurance due to stringent regulatory requirements, leading to elevated costs.

Freight insurance rates for fragile goods, such as glass or electronics, can be particularly high, with premiums that may rise by 20-30% compared to standard cargo. In contrast, hazardous materials can attract danger amplifiers that double the base rate, especially if the shipping route passes through high-theft areas or regions prone to disasters. Indeed, risk multipliers for cargo coverage can reach up to 2x in high-theft zones.

In 2025, freight insurance rates for cargo coverage expenses are projected to range from 0.3% to 1.5% of Total Insured Value (TIV), underscoring the financial implications of transporting different types of goods. Businesses must carefully assess the nature of their cargo and collaborate with insurers to ensure they have adequate coverage. As Troy Patterson notes, "The kind of products being transported affects coverage costs, with delicate, high-value, or perishable items resulting in higher premiums." Understanding the ramifications of transporting fragile and hazardous materials is essential for managing expenses and protecting against potential losses. Furthermore, it is crucial to be aware of policy exclusions, such as those related to war, natural disasters, or inadequate packaging, which can further influence coverage.

Shipping Method: Evaluating How Transport Choices Affect Insurance Costs

The choice of shipping method - air, sea, or land - significantly influences the freight insurance rates. Air freight, known for its speed, typically incurs higher premiums due to the increased risk of theft and damage during transit. Notably, air freight has the highest carbon emissions per ton-mile, which not only affects sustainability goals but also impacts coverage costs. Alarmingly, around 6% of all cargo is lost during transit, underscoring the risks associated with this shipping method.

In contrast, sea freight generally offers lower coverage costs, making it an attractive option for bulk shipments. However, it carries its own risks; factors such as piracy and severe weather can lead to substantial claims, thereby increasing overall expenses. Additionally, political instability in either the country of origin or the destination can elevate premiums, complicating the insurance landscape further.

Land freight serves as a middle ground, balancing cost and flexibility, yet it faces unique challenges. Regional distributors often find land freight to be the most practical choice, but they must navigate regulatory hurdles and traffic congestion, which can drive up costs and cause delays.

When evaluating freight insurance rates, companies must consider the specific risks associated with each transportation method. Items that are flammable, perishable, or high-value typically incur higher coverage expenses, regardless of the shipping method. Moreover, the type of products being transported significantly influences costs; transporting hazardous materials or electronics can lead to higher fees compared to shipping lower-risk items like toys or plastic products. Past losses during cargo transport and submitted claims are factored into an importer’s cargo coverage premium, making effective management practices essential.

Ultimately, conducting a thorough cost-benefit analysis of freight options, including freight insurance rates, is crucial for aligning logistics strategies with business objectives. By understanding the implications of their shipping choices, businesses can optimize their supply chains and manage coverage expenses more effectively. As Haley Mummert noted, cargo insurance costs have been rising over the past year, emphasizing the need for businesses to focus on minimizing exposure to secure better quotes.

Insurance Coverage Limits: Their Effect on Freight Insurance Pricing

Insurance coverage limits play a critical role in defining the maximum payout an insurer will provide in the event of a claim. Higher coverage limits typically lead to increased freight insurance rates, reflecting the greater liability assumed by the insurer.

Companies must conduct a thorough evaluation of their specific needs to determine appropriate coverage limits that effectively balance risk exposure and cost. Insufficient coverage can expose businesses to significant financial losses, especially given rising cargo values and increased theft risks. Conversely, excessive coverage may result in unnecessary expenses.

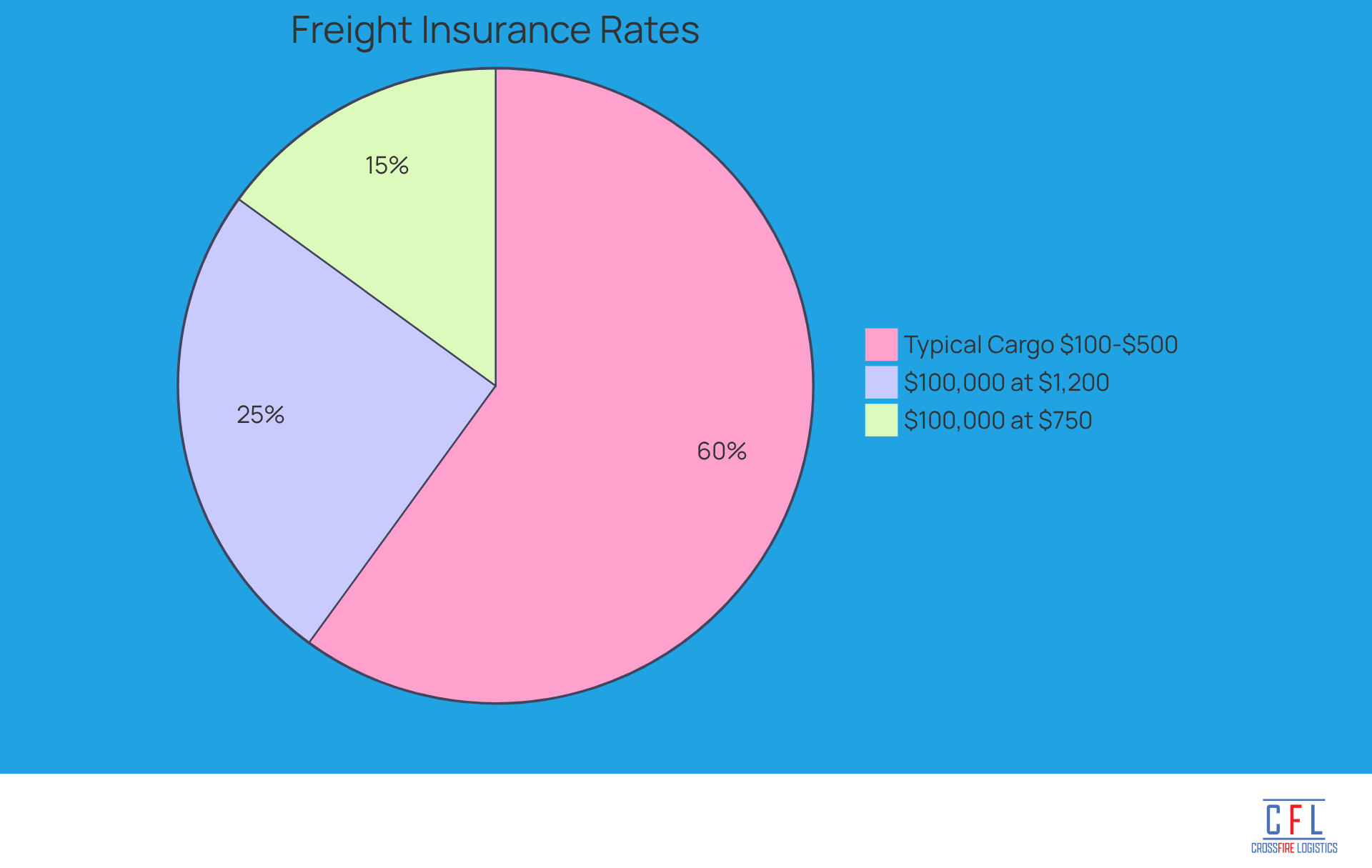

For instance, the freight insurance rates for insuring a $100,000 shipment of electronics could range from $750 to $1,200 for comprehensive coverage, influenced by factors such as the type of cargo and the safety of the route. It is advisable for businesses to cover at least 110% of the cargo's commercial invoice value to ensure adequate protection. As Tiffany Lee notes, "Covering at least 110% of invoice value is a good guideline, but companies should adjust coverage according to their tolerance and client needs."

By strategically managing coverage limits, businesses can optimize their expenses while safeguarding their assets against unforeseen events. The costs for typical cargo protection, also known as freight insurance rates, generally range from $100 to $500 per shipment, depending on size, risk factors, and coverage limits.

Claims History: How Previous Incidents Influence Freight Insurance Rates

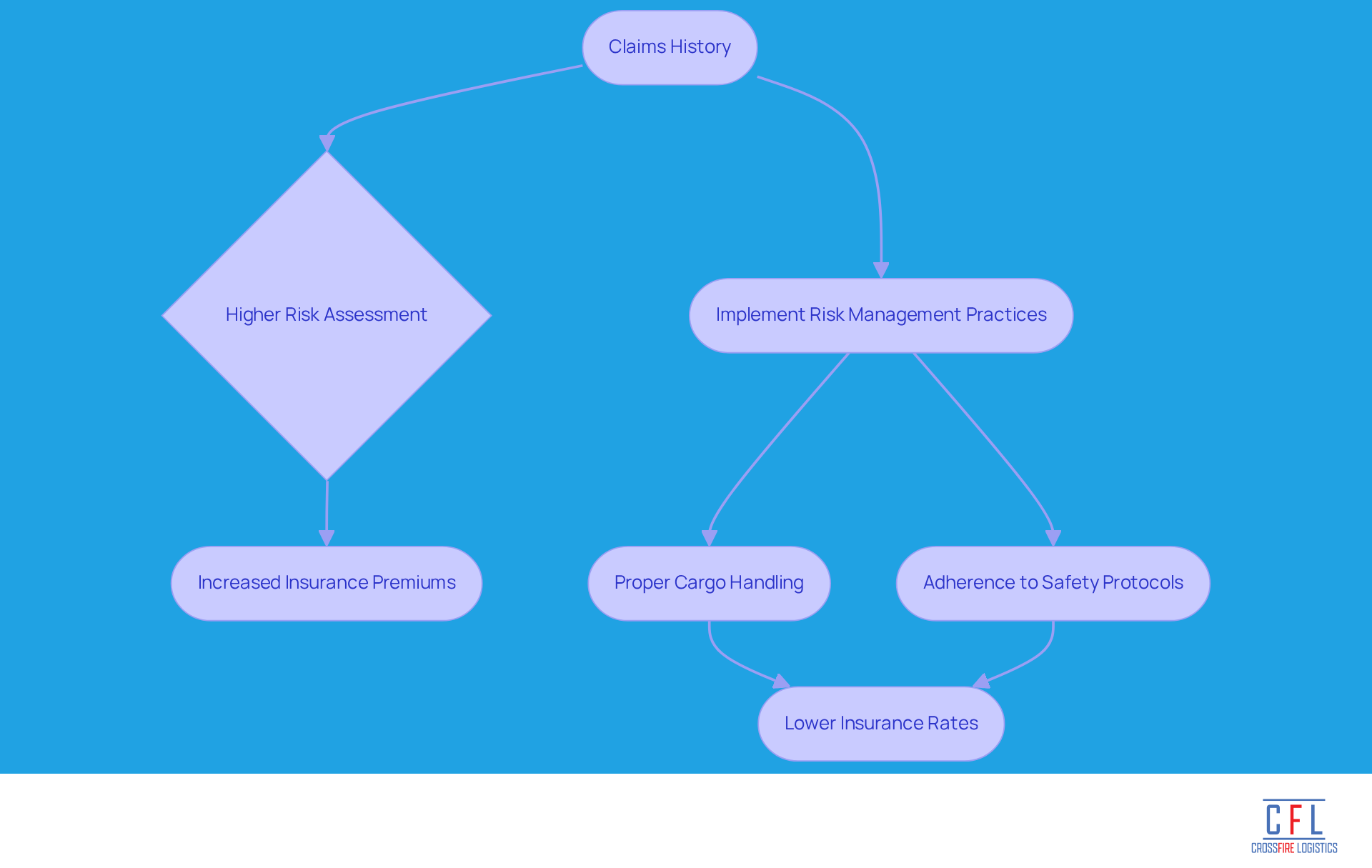

A company's claims history is crucial in determining its freight insurance rates. Insurers view a record of frequent or severe claims as indicative of higher risk, which can lead to increased premiums.

To mitigate this risk, businesses should implement effective risk management practices. Proper cargo handling and adherence to safety protocols are essential strategies for minimizing claims.

Maintaining a clean claims history not only aids in securing lower freight insurance rates but also bolsters the company's reputation with insurers. By prioritizing risk management, businesses can enhance their standing in the insurance market.

Insurer Reputation: The Influence of Financial Stability on Freight Insurance Costs

The financial stability and reputation of an insurer play a critical role in determining the freight insurance rates. Insurers with strong financial backing typically provide more competitive rates and reliable coverage, which is vital for businesses that depend on logistics. Conversely, partnering with less reputable insurers can lead to higher costs and limited coverage options.

For instance, truck coverage costs have surged by 12.5% in just one year and 40% over the past decade. This increase is largely attributed to rising litigation expenses and the prevalence of nuclear verdicts - jury awards exceeding $10 million - which have escalated by 33% from 2010 to 2019. Additionally, the One Big Beautiful Bill Act, which maintains a 21% corporate tax rate for insurers, may further impact their financial stability and pricing strategies.

Given these factors, businesses must conduct thorough research on potential insurers, scrutinizing their financial ratings and customer feedback. This diligence is essential for selecting a trustworthy partner capable of delivering the necessary coverage at a fair price, ultimately protecting their logistics operations. Furthermore, companies that cultivate a safety-first culture may be viewed more favorably by insurers, potentially resulting in improved rates and coverage options.

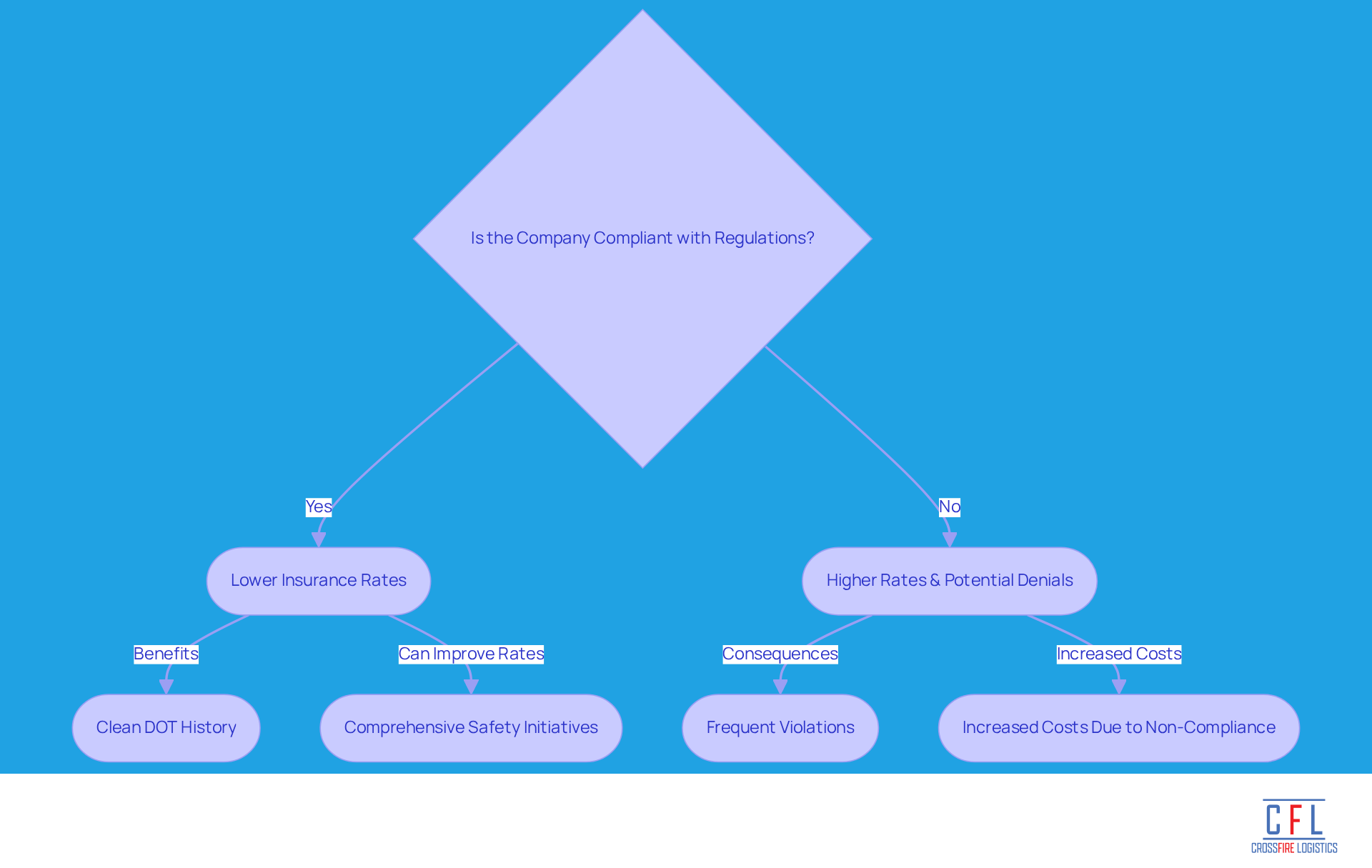

Regulatory Compliance: Understanding Its Role in Freight Insurance Pricing

Regulatory compliance is crucial in determining freight insurance rates. Insurers typically view companies that adhere to industry regulations and safety standards as lower risk, which can significantly reduce their premiums. For instance, companies with a clean DOT compliance history, free from violations or accidents, often enjoy lower coverage costs due to their commitment to safety.

Conversely, companies that do not comply with regulations may encounter higher rates and potential coverage denials. Frequent violations indicate a higher risk to insurers, leading to increased costs. Recent statistics reveal that trucking coverage costs have surged by 12.5%, driven by factors such as nuclear verdicts, underscoring the financial repercussions of non-compliance.

Moreover, organizations that implement comprehensive safety initiatives - such as regular staff training and improved vehicle maintenance - can secure better coverage terms, further optimizing their expenses. By prioritizing adherence to all relevant regulations, businesses not only enhance their operational safety but also position themselves to achieve more favorable coverage costs.

Market Trends: How Economic Conditions Affect Freight Insurance Rates

Market trends and economic conditions significantly influence freight insurance rates. Inflation, supply chain disruptions, and shifts in demand can cause fluctuations in premium pricing.

During periods of economic uncertainty, insurers often increase premiums to account for heightened risks. This trend underscores the importance of staying informed about market dynamics.

Businesses should proactively adjust their insurance strategies to mitigate potential cost increases. By understanding these trends, companies can better navigate the complexities of freight coverage and make informed decisions about freight insurance rates.

Conclusion

Understanding the factors that influence freight insurance rates is crucial for businesses aiming to optimize their logistics strategies and manage costs effectively. Recognizing how elements such as cargo value, shipping routes, type of cargo, and insurance coverage limits impact pricing enables companies to make informed decisions that enhance operational efficiency and reduce expenses.

Key insights emphasize the significance of:

- Operational efficiency

- The nature of the goods being transported

- The reputation of insurers

These factors are essential in determining freight insurance costs. Implementing risk management practices, ensuring documentation accuracy, and maintaining compliance with regulations can significantly lower premiums. Additionally, awareness of market trends allows businesses to anticipate fluctuations and adjust their insurance strategies accordingly.

Ultimately, a proactive approach to understanding and managing these factors not only safeguards assets but also fosters a competitive edge in the logistics landscape. By prioritizing effective logistics practices and staying informed about evolving market conditions, businesses can secure better freight insurance rates and ensure their operations remain resilient in the face of challenges.

Frequently Asked Questions

How do comprehensive logistics solutions impact freight insurance rates?

Comprehensive logistics solutions, like those offered by Crossfire Logistics, optimize operations and ensure timely deliveries, which significantly reduce the likelihood of claims. This reduction in claims is essential for lowering coverage costs.

What role does cargo handling play in freight insurance rates?

Efficient cargo handling mitigates risks and enhances the overall safety of shipments. By improving safety, it boosts customer satisfaction and positions clients favorably with insurance providers, potentially leading to lower expenses.

What are the typical freight insurance rates for domestic shipping routes?

Domestic shipping routes typically feature freight insurance rates ranging from 0.1% to 0.4% of the cargo's value. Companies demonstrating strong operational efficiency may benefit from reduced costs.

How much can logistics firms reduce their freight insurance premiums through effective management?

Logistics firms that implement streamlined processes have successfully decreased their premiums by 10-20%, highlighting the benefits of effective logistics management on freight expenses.

What is the significance of documentation accuracy in freight coverage management?

Ensuring documentation accuracy exceeds 95% is crucial for minimizing claims and further reducing costs in freight coverage management.

How does the value of cargo affect freight insurance costs?

The value of cargo is a key factor in determining freight insurance rates; generally, higher-value items incur greater coverage costs. High-value items may require insurance costs ranging from 0.3% to 1.5% of the Total Insured Value (TIV) in 2025.

What factors should businesses consider when insuring high-value goods?

Businesses must accurately assess the value of their cargo to avoid underinsurance. Additionally, route hazards and a strong claims history can influence coverage expenses, so effective risk management strategies and quality packaging are important.

How does the choice of shipping route affect freight insurance pricing?

The choice of shipping route can significantly influence freight insurance pricing. Routes that pass through high-risk areas, such as those with high theft rates or adverse weather, often result in higher insurance rates.

What strategies can companies use to mitigate costs associated with freight insurance rates?

Companies can mitigate costs by selecting safer shipping routes and partnering with logistics providers known for robust management practices.