Introduction

Navigating the complexities of cargo insurance presents significant challenges for businesses, especially as rates fluctuate due to various factors. Understanding the elements that influence these rates is essential for companies seeking optimal coverage without excessive costs.

With challenges such as rising tariffs, evolving shipping routes, and the increasing value of goods, businesses must find effective ways to balance cost and protection. This article explores ten key factors that impact cargo insurance rates, providing insights that empower companies to make informed decisions in a competitive landscape.

Crossfire Logistics: Streamlining Cargo Insurance Management for Competitive Rates

Crossfire Logistics stands out in the logistics industry by offering comprehensive management that effectively balances the cargo insurance rate with coverage. The company leverages its extensive warehousing capabilities and strategic positioning to secure competitive coverage rates. This is accomplished through thorough risk evaluations and proactive engagement with coverage providers, enabling the customization of protection to meet specific client needs.

Recent trends show that the cargo insurance rate is affected by rising tariffs and increasing cargo values. This situation necessitates a strategic approach to negotiations. Crossfire's commitment to customer satisfaction not only enhances its negotiating power but also ensures clients receive favorable terms. This ultimately improves their operational efficiency and financial outcomes.

Effective negotiation tactics employed by Crossfire include:

- Utilizing historical claims data

- Understanding market dynamics

- Maintaining open communication with insurers

These strategies collectively contribute to optimized coverage solutions that adapt to the evolving needs of their clients.

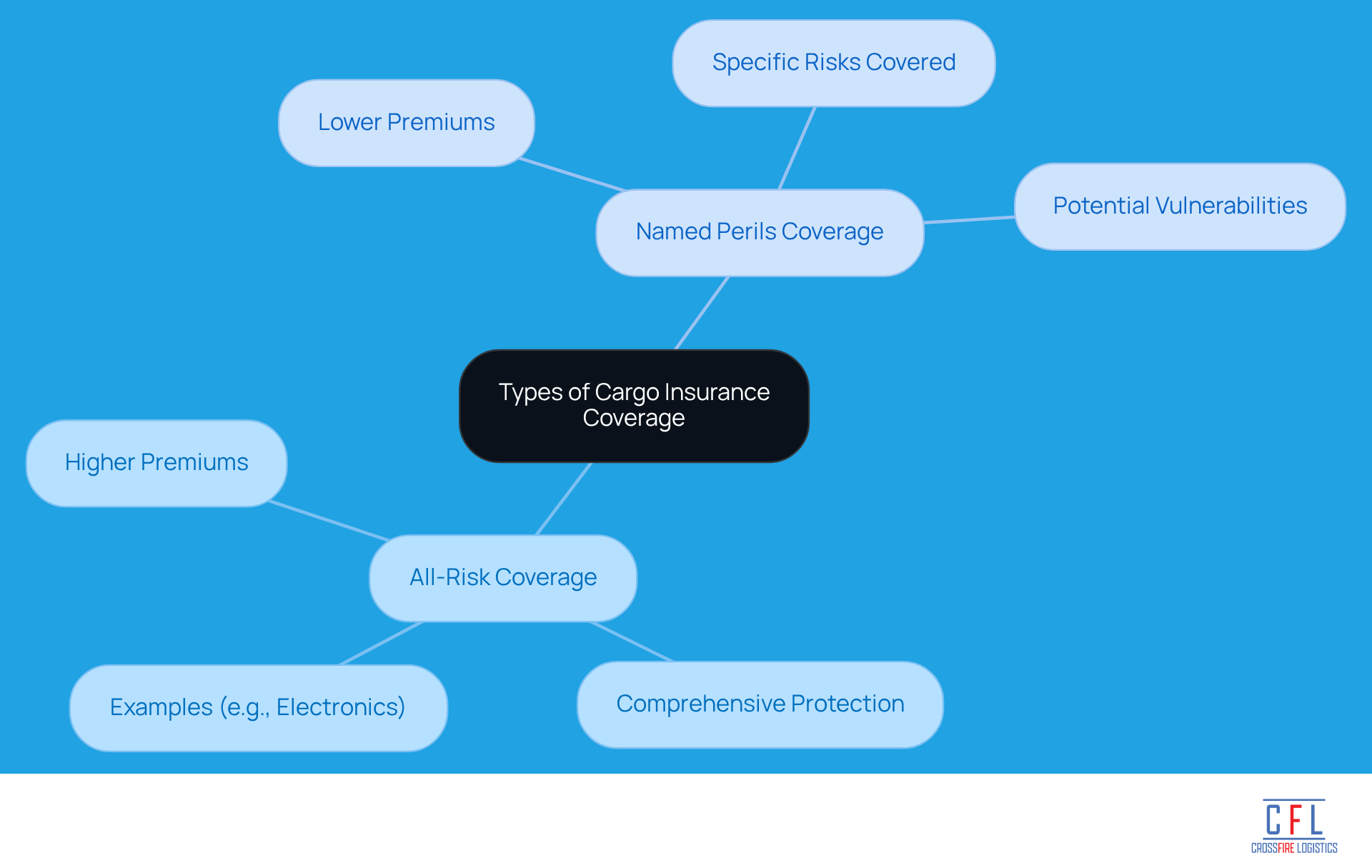

Types of Coverage: How Different Policies Affect Your Cargo Insurance Rate

The cargo insurance rate is affected by various types of cargo protection, primarily all-risk and named perils coverage, each carrying significant implications. Cargo insurance rates typically range from 0.3% to 1% of the insured value. All-risk policies provide comprehensive coverage against a wide array of potential losses, which usually results in higher premiums. For instance, companies transporting valuable electronics often opt for comprehensive coverage to safeguard against numerous threats, despite the increased cost.

High-value or high-risk goods typically incur a cargo insurance rate of 0.5% to 1% or more. Conversely, named perils policies cover only specific risks, such as theft or fire. While this can lead to reduced premiums, it may leave businesses vulnerable to uncovered losses. A logistics company that selects named perils coverage might save on costs but could face significant financial exposure if an unforeseen event occurs.

Understanding these distinctions is vital for companies aiming to select the most economical coverage that aligns with their exposure profile, particularly when considering the cargo insurance rate. Furthermore, the choice between these policies can greatly influence the cargo insurance rate quotes; all-risk policies typically command higher premiums due to their comprehensive nature, while named perils policies can offer more budget-friendly cargo insurance rate options at the cost of broader coverage.

As companies navigate their coverage needs, grasping how named perils impact freight protection rates is essential for effective financial planning. Looking ahead to 2025, higher premiums are expected due to climate-related challenges and new trade regulations, making it increasingly important for businesses to balance costs with adequate coverage tailored to their specific requirements.

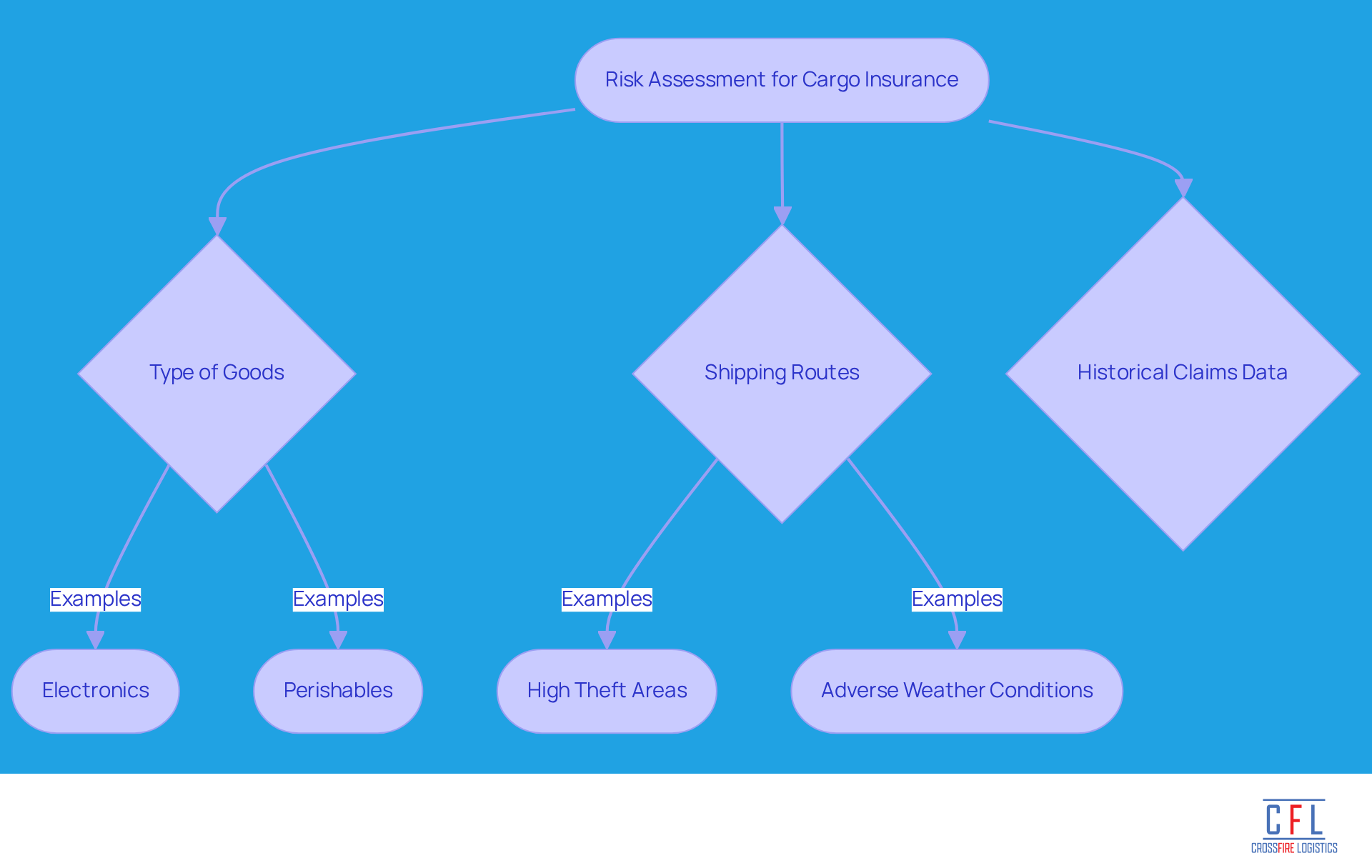

Risk Assessment: Evaluating Factors That Influence Cargo Insurance Pricing

Insurers assess various factors when determining the cargo insurance rate, including the type of goods, shipping routes, and historical claims data. High-risk items, such as electronics and perishables, typically incur higher premiums due to their susceptibility to damage or theft. For instance, the cargo insurance rate in 2025 ranges from 0.3% to 1.5% of the Total Insured Value (TIV), influenced by factors such as shipment value and route uncertainties. Shipping routes that pass through areas known for high theft rates or adverse weather conditions can significantly elevate the cargo insurance rate.

A comprehensive evaluation of potential risks enables companies to pinpoint vulnerabilities, such as unauthorized stops or temperature deviations, which may lead to increased claims. Businesses that regularly review their shipping routes and carrier performance often find opportunities to negotiate better coverage terms and reduce premiums. Furthermore, understanding the complexities of global shipments, including customs delays and compliance issues, is crucial for effectively managing uncertainties. By leveraging insights from industry experts and employing advanced technologies like IoT for real-time monitoring, companies can strengthen their freight protection strategies and mitigate financial risks associated with shipping.

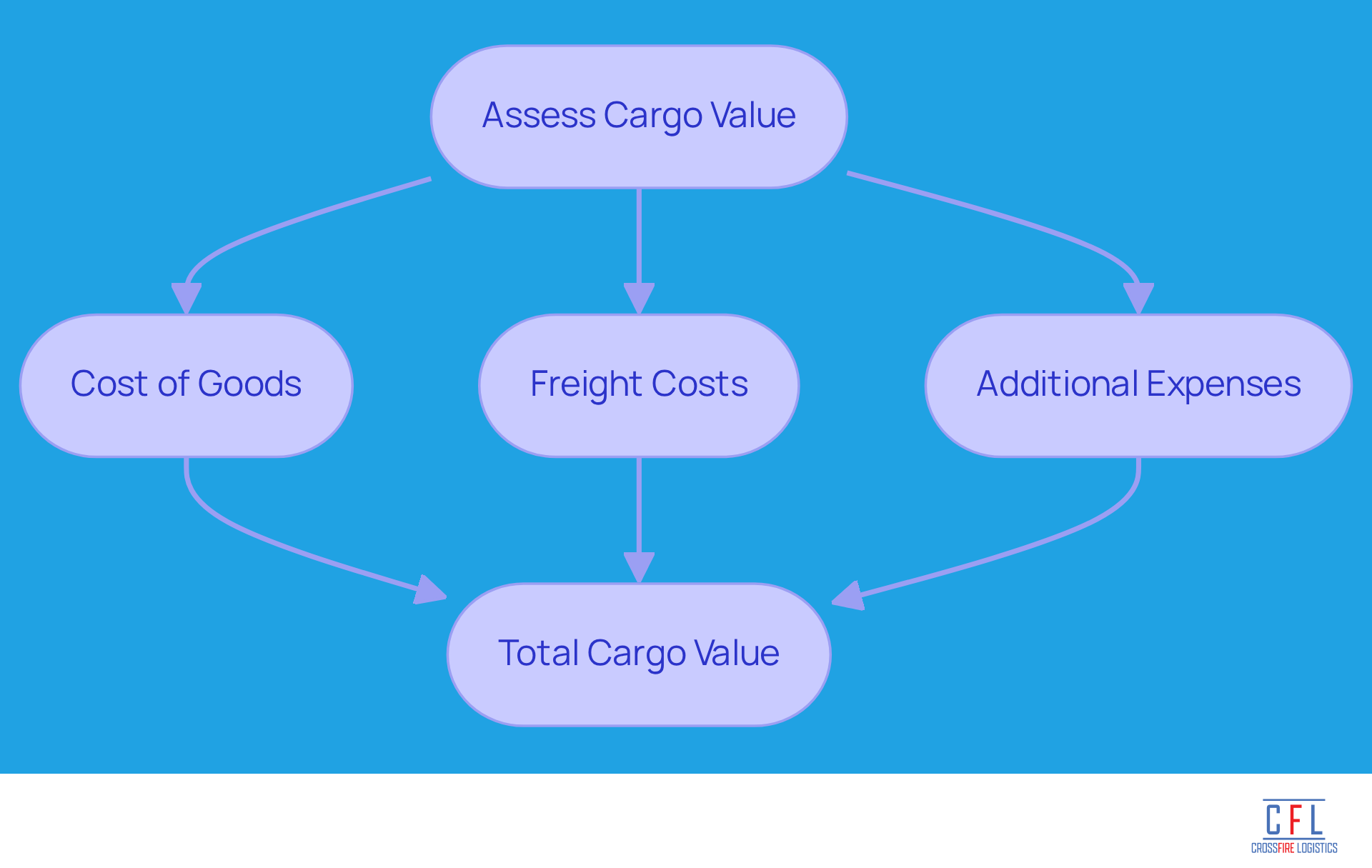

Cargo Value: Understanding Its Role in Determining Insurance Costs

Assessing the worth of goods is crucial for determining coverage expenses. Higher-value shipments generally incur a higher cargo insurance rate due to the increased potential for loss. Therefore, companies must evaluate the worth of their shipments accurately. This evaluation should encompass the cost of goods, freight, and any additional expenses. By doing so, businesses can ensure they are adequately protected without overpaying for their cargo insurance rate. This valuation process is essential for aligning coverage with actual exposure.

Shipping Routes: Analyzing How They Impact Cargo Insurance Rates

Shipping paths are pivotal in determining the cargo insurance rate. Routes traversing high-risk areas, such as those susceptible to piracy or severe weather, often result in a higher cargo insurance rate. Insurers assess the hazards associated with each route to determine the cargo insurance rate, taking into account historical loss data and current geopolitical conditions. In 2025, cargo coverage premiums reached $25 billion, reflecting an 8.3% increase from 2023, underscoring the financial implications of these challenges.

To mitigate these expenses, companies can opt for safer routes or adopt management strategies, such as partnering with reliable carriers known for their strong safety records. A case study of a logistics company demonstrated that by rerouting shipments away from high-threat areas, they achieved a 15% reduction in total coverage costs, showcasing the effectiveness of proactive threat management.

Additionally, the growing concern over domestic freight theft highlights the importance of thorough evaluations in managing expenses.

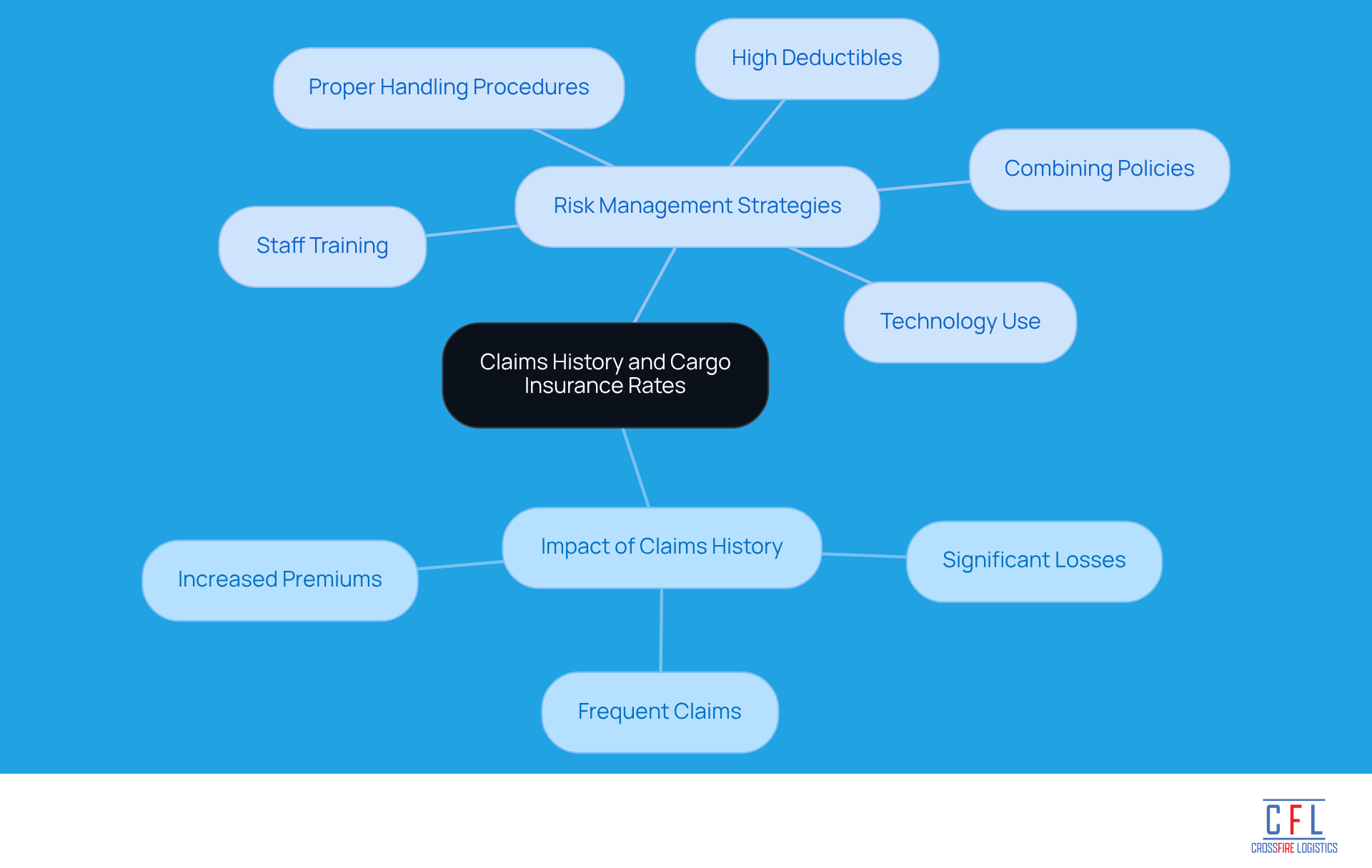

Claims History: The Effect of Past Incidents on Your Cargo Insurance Rate

A company's claims history plays a vital role in determining cargo insurance rate. Frequent claims or significant losses signal higher risk to insurers, resulting in increased premiums. In 2025, uninsured losses average over $50,000 per incident, highlighting the financial impact of claims.

To address this risk, businesses should prioritize minimizing claims through effective risk management practices. This includes:

- Implementing proper handling procedures

- Providing regular training for staff

By maintaining a clean claims history, companies can negotiate better terms and a lower cargo insurance rate with their insurance providers.

Additionally, strategies such as:

- Combining freight coverage with liability policies

- Adopting high deductibles of $10,000 or more

can lead to savings of 20-30%. Furthermore, leveraging technology for monitoring shipments-such as GPS and IoT-can further reduce claims and enhance overall outcomes.

Deductibles: Balancing Risk and Cost in Cargo Insurance Policies

Deductibles represent the out-of-pocket amounts that policyholders must pay before their freight insurance coverage becomes effective. Generally, higher deductibles lead to lower premiums, as insurers assume less risk. For instance, opting for a deductible of 1-2% of the cargo value for high-value shipments can significantly reduce premium expenses by 20-40%.

To illustrate, consider a claim valued at $5,000. With an $800 deductible, the insurer covers $4,200, demonstrating how deductibles influence payouts. However, businesses must assess their financial capacity to manage these expenses in the event of a claim. For example, a claim valued at $50,000 with a $1,000 deductible results in the insurer covering $49,000. This highlights the importance of selecting a deductible that aligns with both risk tolerance and financial stability.

With the US de minimis ending on August 29, 2025, it is essential for businesses to review their deductible choices in light of these regulatory changes. Striking the right balance between deductible amounts and premium expenses is crucial for effective management of the cargo insurance rate in freight protection. This ensures that businesses maintain adequate coverage without jeopardizing their financial resources.

Regularly examining coverage agreements can uncover opportunities for savings and adjustments based on evolving business needs. Therefore, it is vital for logistics operators to stay informed about their options. As logistics specialist Tiffany Lee notes, for high-value shipments, selecting deductibles at 1-2% of shipment value is advisable to achieve a balance between premiums and risk.

Market Trends: Understanding Their Impact on Cargo Insurance Pricing

The cargo coverage market faces significant challenges, particularly due to rising claims expenses. Factors such as increased cargo theft and escalating litigation fees have driven this trend. Companies have reported a notable surge in claims, with some estimates indicating that concealed expenses can inflate insurance premiums by 10-30% or more. This rise in claims not only affects short-term costs but also influences the cargo insurance rate set by insurers, leading to universally higher premiums.

To address these escalating claims costs, companies are adopting enhanced security measures and investing in technology aimed at risk mitigation. Engaging with knowledgeable brokers is crucial, as they provide valuable insights into market dynamics and help businesses secure competitive cargo insurance rates. By staying informed about these trends and proactively adjusting logistics strategies, companies can better navigate the complexities of freight coverage pricing and safeguard their financial interests.

Insurance Providers: Choosing the Right Partner for Competitive Cargo Rates

Choosing the right provider is crucial for securing competitive cargo insurance rates. Businesses must evaluate potential insurers based on three key criteria:

- Reputation: Assess the insurer's standing in the industry.

- Claims Handling Process: Understand how efficiently they manage claims.

- Coverage Options: Review the variety of coverage they offer.

Additionally, engaging with brokers who specialize in freight coverage can provide access to a wider range of options and potentially better cargo insurance rates. Building strong relationships with coverage providers can lead to more favorable terms and conditions, ultimately enhancing the company's logistics operations.

Policy Reviews: Keeping Your Cargo Insurance Aligned with Current Needs

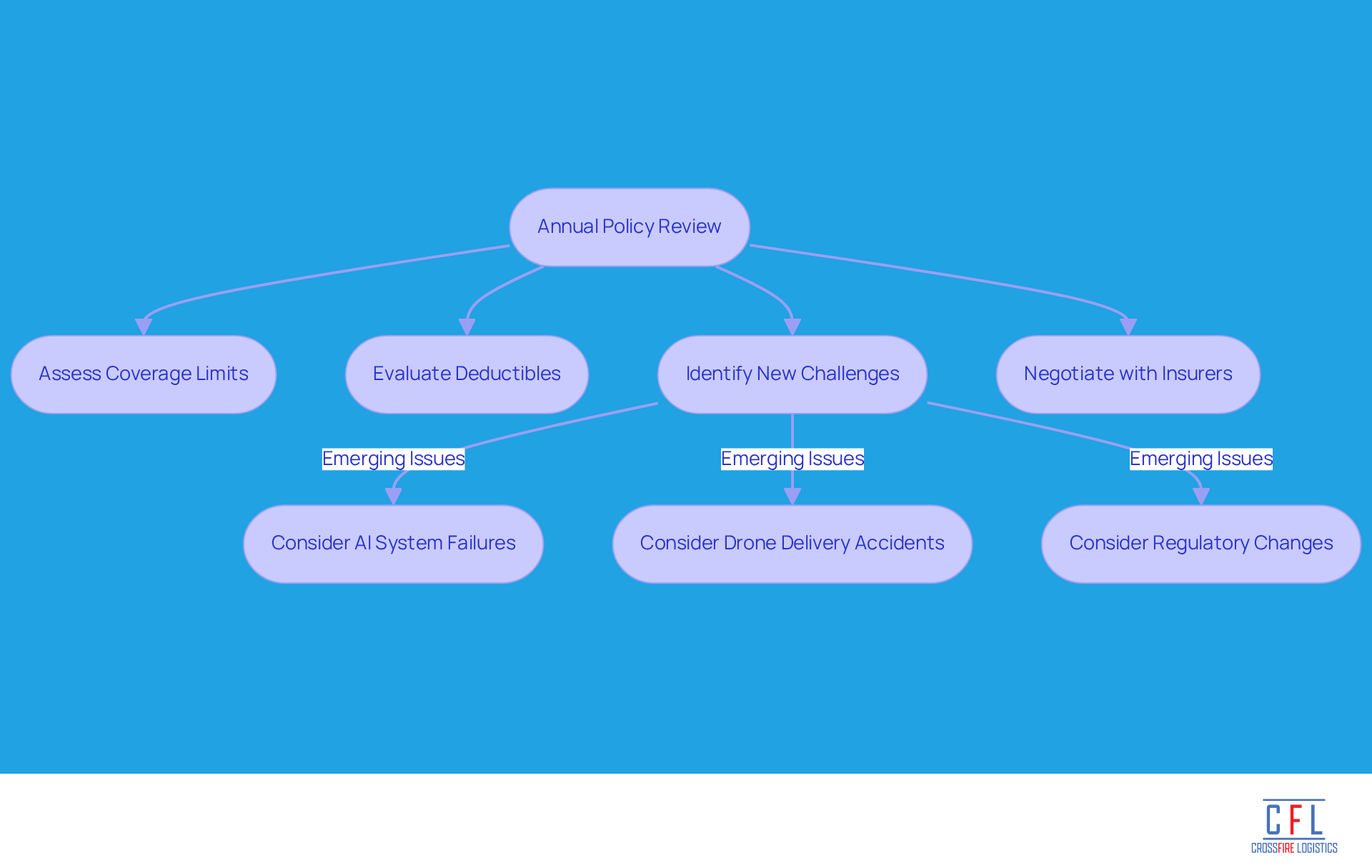

Regular policy evaluations are crucial for ensuring that cargo protection coverage meets a business's evolving needs. As companies grow and adapt, their insurance requirements frequently change. Conducting annual assessments enables businesses to review their coverage limits, deductibles, and any new challenges, including emerging issues like AI system failures and drone delivery accidents, which are increasingly common in 2025.

This proactive approach not only ensures adequate protection but also opens up opportunities for negotiating improved conditions with insurers based on updated evaluations. For example, businesses that have adopted new technologies or expanded their shipping routes may discover that their previous policies are insufficient, necessitating adjustments to their coverage.

Moreover, with claims now being processed and paid out within hours due to technological advancements, staying ahead of these changes allows companies to manage costs effectively and enhance their overall risk management strategies. As highlighted by Lars Lange, geopolitical tensions and climate change are significant factors that can influence insurance needs, underscoring the importance of regular reviews.

Conclusion

Understanding the factors that influence cargo insurance rates is essential for businesses aiming to optimize their coverage while effectively managing costs. The complexity of cargo insurance pricing is shaped by various elements, including:

- The type of coverage chosen

- The value of the cargo

- Shipping routes

- Claims history

- Market trends

By strategically navigating these factors, companies can secure competitive rates tailored to their specific needs.

Key insights from this exploration underscore the importance of:

- Thorough risk assessments

- The impact of deductible choices

- The necessity of selecting the right insurance provider

Businesses that engage in regular policy reviews and maintain open communication with insurers are better positioned to adapt to changing market conditions and mitigate potential financial risks.

As the logistics landscape continues to evolve, staying informed and proactive empowers companies to make sound decisions regarding cargo insurance. Embracing these strategies not only enhances financial outcomes but also strengthens operational resilience in an increasingly complex environment. Companies are encouraged to assess their current insurance strategies and consider adjustments that align with the latest trends and their unique operational needs.

Frequently Asked Questions

What is Crossfire Logistics known for in the logistics industry?

Crossfire Logistics is recognized for offering comprehensive management that balances cargo insurance rates with coverage, leveraging extensive warehousing capabilities and strategic positioning to secure competitive coverage rates.

How does Crossfire Logistics secure competitive coverage rates?

The company secures competitive coverage rates through thorough risk evaluations and proactive engagement with coverage providers, allowing for customized protection that meets specific client needs.

What recent trends are affecting cargo insurance rates?

Rising tariffs and increasing cargo values are recent trends impacting cargo insurance rates, necessitating a strategic approach to negotiations.

What negotiation tactics does Crossfire Logistics employ?

Crossfire employs effective negotiation tactics such as utilizing historical claims data, understanding market dynamics, and maintaining open communication with insurers to optimize coverage solutions.

What are the main types of cargo insurance coverage?

The main types of cargo insurance coverage are all-risk policies, which provide comprehensive coverage against a wide array of potential losses, and named perils policies, which cover only specific risks like theft or fire.

How do cargo insurance rates typically range?

Cargo insurance rates typically range from 0.3% to 1% of the insured value, with higher rates for high-value or high-risk goods.

What are the implications of choosing all-risk versus named perils coverage?

All-risk policies generally command higher premiums due to their comprehensive nature, while named perils policies can offer lower premiums but may leave businesses vulnerable to uncovered losses.

What factors influence cargo insurance pricing?

Factors influencing cargo insurance pricing include the type of goods, shipping routes, historical claims data, and the susceptibility of items to damage or theft.

What is the expected cargo insurance rate range for 2025?

The expected cargo insurance rate range for 2025 is between 0.3% to 1.5% of the Total Insured Value (TIV), influenced by shipment value and route uncertainties.

How can businesses reduce their cargo insurance premiums?

Businesses can reduce premiums by regularly reviewing shipping routes, carrier performance, and understanding potential risks, which may allow for better negotiation of coverage terms.