Introduction

Understanding the complexities of freight insurance is essential for businesses navigating logistics. As companies increasingly depend on comprehensive coverage to protect their goods during transit, the costs associated with freight insurance become a significant concern.

What factors truly influence these costs? How can businesses effectively calculate and manage them to safeguard their operations? This article explores the key elements of freight insurance, providing insights into cost calculation strategies and practical approaches to minimize expenses while ensuring robust protection.

Define Freight Insurance and Its Importance in Logistics

Freight coverage, also known as cargo coverage, is a specialized policy designed to protect goods during transit. This coverage addresses losses that may arise from damage, theft, or other unforeseen incidents occurring during transport. The importance of freight coverage in logistics is significant; it shields businesses from considerable financial losses associated with damaged or lost shipments. By investing in freight insurance cost, companies can ensure their supply chain remains resilient, preserving customer trust and operational continuity even amidst unexpected challenges.

Recent trends indicate a growing awareness of the need for comprehensive coverage, with many logistics firms opting for all-peril policies that provide extensive protection against various threats, including natural disasters and theft. All-risk coverage compensates for damages resulting from negligence, poor packaging, customs rejection, and other risks, making it an essential element of effective logistics management. Statistics reveal that businesses utilizing freight coverage experience fewer disruptions, thereby enhancing their overall supply chain management. For instance, firms that implement robust cargo protection strategies report a marked improvement in their ability to recover from incidents, thus bolstering their operational stability.

Furthermore, the benefits of freight coverage extend beyond mere financial protection; it cultivates stronger relationships with clients by ensuring timely deliveries and safeguarding their interests. As highlighted in the case study on Marine Cargo Coverage, this form of protection is vital for companies engaged in global goods transportation, addressing the complexities and risks associated with such operations. As the logistics landscape evolves, the emphasis on freight protection as a fundamental aspect of effective supply chain management continues to grow, establishing it as an indispensable tool for businesses striving to thrive in a competitive environment.

Identify Key Factors Influencing Freight Insurance Costs

Several key factors significantly influence freight insurance costs:

-

Cargo Value: The value of the shipment is a primary determinant of insurance premiums. The freight insurance cost for higher-value shipments typically incurs premiums ranging from 0.3% to 1.5% of the total insured value (TIV), reflecting the increased risk associated with potential loss or damage. For instance, shipments worth more than $50,000 may experience increased premiums due to the greater risks involved, with typical cargo coverage expenses in 2025 averaging approximately 0.7% for standard shipments.

-

Type of Goods: The nature of the goods being shipped also plays a crucial role. Fragile items or hazardous materials often attract higher rates due to their susceptibility to damage and the additional regulatory requirements for safe transport.

-

Shipping Routes: The chosen shipping route can significantly affect premiums. Routes that pass through regions with elevated theft rates or unfavorable weather conditions may result in higher insurance expenses. For example, international routes through high-risk regions can see the freight insurance cost rise to 0.5% or more, especially in areas prone to severe weather or political instability.

-

Coverage Level: The extent of coverage chosen-whether all-risk or named perils-directly affects the price. All-risk coverage, which provides comprehensive protection, is generally more expensive but essential for high-value or critical shipments.

-

Company Size and Claims History: Larger companies or those with a record of frequent claims may encounter higher premiums due to perceived risk. A company's claims history can impact future premium expenses, with a pattern of frequent claims resulting in higher freight insurance costs. Moreover, high-volume shippers can secure improved rates due to their regular transactions, demonstrating how increased shipping volume can lead to reduced expenses for coverage.

Understanding these elements allows companies to customize their coverage plans efficiently, ensuring sufficient protection while potentially reducing expenses. Additionally, rising premiums may affect market capacity, as smaller providers could exit the market due to heightened financial pressures, emphasizing the broader implications of coverage expenses on the logistics sector.

Calculate Freight Insurance Costs: A Step-by-Step Guide

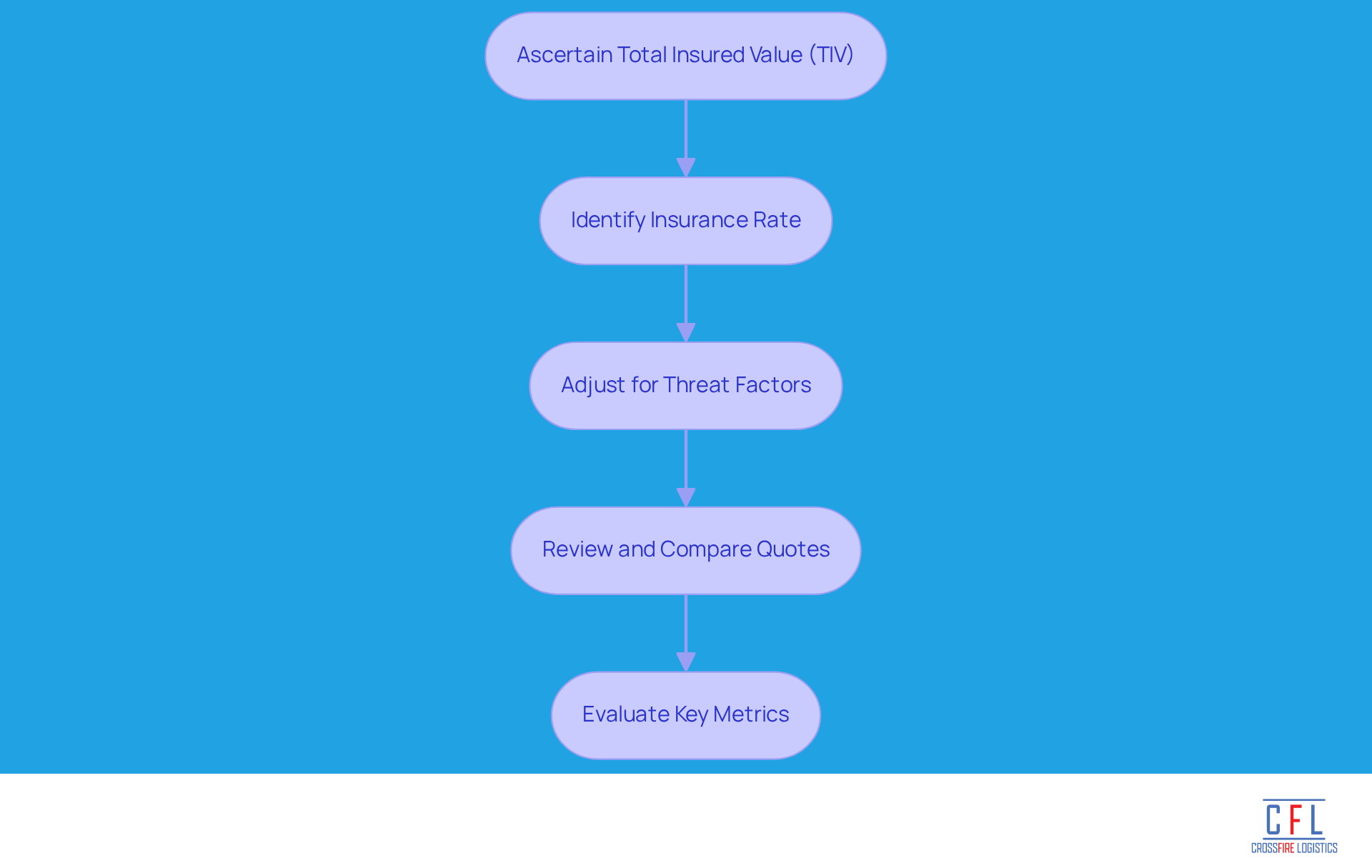

Calculating the freight insurance cost requires a systematic approach to ensure comprehensive coverage for your shipments. Here’s how to do it:

-

Ascertain the Total Insured Value (TIV): This encompasses the value of the goods, transportation fees, and any additional expenses. For instance, if your items are valued at $100,000 and shipping expenses total $10,000, your TIV would be $110,000.

-

Identify the Insurance Rate: This rate is generally a percentage of the TIV. In 2025, cargo coverage expenses typically range from 0.3% to 1.5% of the TIV. For example, if the insurance rate is 0.5%, the calculation would be:

- Insurance Cost = TIV x Insurance Rate

- Insurance Cost = $110,000 x 0.005 = $550.

-

Adjust for Threat Factors: Evaluate any additional threat factors that may influence the rate, such as the type of goods or the shipping route. For example, electronics may incur higher premiums due to theft risk, while perishable items like food and flowers could have coverage rates varying from 0.3% to 0.7% because of spoilage concerns.

-

Review and Compare Quotes: Collect quotes from various insurers to ensure competitive pricing and adequate coverage. The typical cost of cargo protection can range from $100 to $500 per shipment, depending on size, risk, and coverage limits. Additionally, high-volume shippers may have opportunities to negotiate lower coverage rates, which can help manage expenses.

-

Evaluate Key Metrics: Beyond price, consider factors such as claim responsiveness, exclusions, and the insurer's reputation to avoid surprises during claims. By following these steps, businesses can accurately determine their freight insurance cost, which ensures robust protection against potential losses during transit.

Implement Strategies to Lower Freight Insurance Costs

To effectively lower freight insurance costs, consider the following strategies:

-

Conduct Regular Risk Assessments: Regularly evaluate your shipping practices and routes to identify potential risks. This proactive strategy can lead to significant savings, as efficient hazard management can lower the freight insurance cost by up to 15%.

-

Enhance Packaging: Investing in premium materials reduces the risk of damage during transport, which can directly lower the freight insurance cost. Good packaging practices not only protect goods but also enhance overall logistics efficiency.

-

Choose Reliable Carriers: Collaborating with carriers that have strong safety records and lower claims rates can positively impact your expenses. Carrier ratings from organizations like Demotech can assist in assessing the reliability of potential partners.

-

Increase Deductibles: Increasing deductibles can lead to a reduction in freight insurance cost. However, ensure that your enterprise is prepared to handle the expenses in the event of a claim, as this strategy requires careful financial planning.

-

Combine Coverage Plans: Consider merging freight coverage with other commercial policies to benefit from multi-plan discounts. This approach can optimize your coverage management and potentially reduce total expenses.

By applying these tactics, companies can effectively manage and lower their freight insurance cost while maintaining essential coverage. Routine risk evaluations and upgraded packaging are particularly effective, as they not only enhance safety but also lead to long-term savings on coverage costs. Furthermore, it is crucial to understand policy exclusions, as studies indicate that 70% of business owners do not fully grasp these terms, which can result in unforeseen expenses and rejected claims. Thorough documentation is also vital for successful claims, underscoring the importance of proper practices in managing insurance costs.

Conclusion

Freight insurance is a vital safeguard for businesses, protecting valuable goods during transit from potential losses due to damage, theft, or unforeseen incidents. Its importance in logistics is significant, as it not only mitigates financial risks but also enhances operational resilience and customer trust. By grasping the intricacies of freight insurance costs and implementing effective strategies, companies can navigate the complexities of logistics with greater confidence and security.

Several key factors influence freight insurance costs, including:

- Cargo value

- The nature of the goods

- Shipping routes

- Coverage levels

- The size and claims history of the company

Each of these elements plays a crucial role in determining premiums, highlighting the necessity for businesses to carefully evaluate their coverage plans. Strategies such as:

- Conducting regular risk assessments

- Enhancing packaging

- Selecting reliable carriers

- Increasing deductibles

- Combining coverage plans

can significantly reduce expenses while ensuring adequate protection.

Ultimately, prioritizing freight insurance is essential for businesses aiming to succeed in a competitive landscape. By investing in comprehensive coverage and actively managing insurance costs, companies can protect their assets and foster stronger relationships with clients, ensuring smoother operations. Embracing these practices will lead to a more resilient supply chain, enabling businesses to effectively navigate any challenges that may arise in their logistics journey.

Frequently Asked Questions

What is freight insurance?

Freight insurance, also known as cargo coverage, is a specialized policy designed to protect goods during transit from losses that may arise due to damage, theft, or other unforeseen incidents.

Why is freight insurance important in logistics?

Freight insurance is important because it shields businesses from significant financial losses associated with damaged or lost shipments, ensuring supply chain resilience, preserving customer trust, and maintaining operational continuity during unexpected challenges.

What recent trends are observed in freight insurance?

Recent trends show a growing awareness of the need for comprehensive coverage, with many logistics firms opting for all-peril policies that provide extensive protection against various threats, including natural disasters and theft.

What does all-risk coverage include?

All-risk coverage compensates for damages resulting from negligence, poor packaging, customs rejection, and other risks, making it an essential part of effective logistics management.

How does freight insurance impact supply chain management?

Businesses utilizing freight insurance experience fewer disruptions, which enhances their overall supply chain management and improves their ability to recover from incidents, thus bolstering operational stability.

What are the additional benefits of freight coverage?

Beyond financial protection, freight coverage helps cultivate stronger relationships with clients by ensuring timely deliveries and safeguarding their interests.

Why is marine cargo coverage significant for global transportation?

Marine cargo coverage is vital for companies engaged in global goods transportation as it addresses the complexities and risks associated with such operations.

How is the emphasis on freight protection evolving in logistics?

The emphasis on freight protection is growing as a fundamental aspect of effective supply chain management, establishing it as an indispensable tool for businesses striving to thrive in a competitive environment.